Management Information

Financial Highlights

Operating Results

Net Sales (Millions of Yen)

Operating Income (Millions of Yen)

Ordinary Profit (Millions of Yen)

Net Income Attributable to Owners of the Parent Company (Millions of Yen)

ROE (%)

Net Income per Share (Yen)

Financial Position

Total Assets (Millions of Yen)

Net Assets (Millions of Yen)

Net Assets per Share (Yen)

Cash Flow Status

Cash flows from Operating activities (Millions of Yen)

Cash flows from Investing activities (Millions of Yen)

Cash flows from Financing activities (Millions of Yen)

Cash and Cash equivalents at the end of period(Millions of Yen)

Corporate Governance

Basic Stance on Corporate Governance

The Company strives to strengthen corporate governance based on recognition for the importance of ensuring the transparency/health of management and executing appropriate management in order to increase the corporate value, which is the inherent purpose of a corporation.

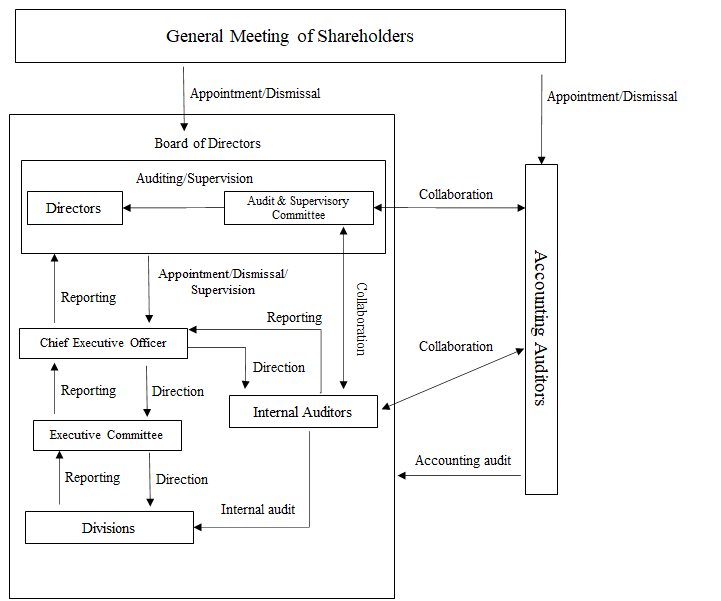

Structure

Business Risks

Among the matters related to business conditions, accounting conditions, etc., the following matters may have a significant impact on the judgment of investors.

Note that forward-looking matters listed in the text of this section were determined by the Company as of the submission date.

(1) Changes in Market Trends, Core Business, and the Business Environment

The CLOMO business, which is the core business of the Group, provides MDM service for enterprises in the form of SaaS using cloud by subscription contract. A client company lends mobile devices (smartphones, tablets, etc.) in which CLOMO is installed to its employees, etc. The mobile devices can then be used to provide information to employees, receive deliverables from employees, manage the working hours of employees, etc.

However, the business is influenced by domestic and overseas economic conditions and the trends at client companies. Furthermore, technological evolution is rapid and the customer needs continue to diversify. If the Company fails to respond to such changes in the business environment, the Group’s financial condition and management performance may be affected.

(2) Dependence on Specific Business Partners

Most of the sales transactions in our mainstay CLOMO business are made through mobile phone sales companies and mobile phone sales dealers, and group companies of our top customer accounted for 50.2% of total sales (actual results for the period ended June 30, 2024).Although we have built good relationships with our sales partners, an unexpected sales policy change could arise at a partner, or a serious problem could occur that is attributed to the Group. In the event that a good business relationship is affected in this way, the Group’s financial condition and management performance may be affected.

(3) Dependence on Specific Business

While the Group’s activities include the CLOMO and investment business areas, no sales were recorded for the investment business as of the date of submission. Therefore, all sales for the fiscal year under review occurred in the CLOMO business. Accordingly, if trends in the CLOMO business’s MDM market do not unfold as expected, or if the Group is unable to respond appropriately to changes in the business environment, the Group’s financial condition and management performance may be affected. On the other hand, as described in (4) below, the Group’s policy is to develop new businesses to diversify our revenue sources, and we will build an alternative revenue base.

(4) New Businesses

Although the Group’s core business is the CLOMO business, in order to diversify our revenue sources, it is our policy to develop new businesses while carefully considering risks. If the development or monetization of a new business does not proceed as planned, investment may not be recovered due to the need to record an impairment loss, etc. Moreover, depending on the content of the new business, there could be additional business-specific risk. The Group’s financial condition and management performance may be affected, depending on the content of or progress made in these new businesses.

(5) Cancellations Associated with End Users Switching Mobile Devices

In the core CLOMO business, in conjunction with sales of mobile devices by mobile phone sales companies and mobile phone sales dealers, the Group enters into contracts with end users which are client companies. Consequently, if an end user switches to a mobile device sold by another company due to factors such as deterioration in the relationship between end users and mobile phone sales companies or mobile phone sales dealers, there is the possibility that said contracts may be cancelled due to no fault of the Group. Although the Group anticipates future cancellations when formulating our budget and management plan, the Group’s financial condition and management performance may be affected if cancellations exceed our forecasts.

To address such risk, we have built a robust support system to quickly resolve any customer issues. Furthermore, we conduct regular interviews with customers to strengthen our relationships with them and provide step-up seminars for them to learn how to better use CLOMO MDM. Through these support and customer success activities, we are working to ensure that customers can continue to use our products even if they switch mobile devices.

(6) Competition

In the CLOMO business’s MDM market, price competition is intensifying due to new entrants and competition from other companies. If a contract could not be secured at the expected unit price, it may affect the Group’s financial condition and management performance.

Furthermore, the Group provides CLOMO services using the OS and infrastructure provided by platformers such as Apple Inc., Google LLC, and Microsoft Corporation. These platformers also provide their own MDM services. If such platformers change the fee system or usage restrictions applied to the Group, or if the platformers stop providing services to the Group, the Group’s financial condition and management performance may be affected.

(7) Information Security and Information Leakage

The Group handles the information assets of many client companies related to our business. We strive to thoroughly manage information by formulating Information System Management Rules, conducting education/training on information security for officers and employees, etc. Moreover, we are strengthening our information security by using systems with integrated threat management functions and by implementing measures such as reviews by outside experts.

In addition to the possibility of external cyber-attacks, there are the risks of important data deletion due to employee negligence, and the potential for unauthorized information access by employees. In the event of a situation such as these, or the leak of important information assets to an external party for any reason, the Group’s financial condition and management performance may be affected by the resulting loss of trust from society, or a liability to pay for damages, etc.

(8) Litigation

There has been no major litigation, complaints, or other problems with third parties that would impact future management performance. However, as the Group proceeds with its business activities, there are risks of becoming subject to a range of litigation, such as with intellectual property rights, the environment, labor, etc. In the event that major litigation causes concern about a significant impact on future results, or depending on the outcome of litigation, this may affect the Group’s business or management performance. In light of such risks, when conducting business activities we strive to enhance internal control and to strengthen compliance.

Moreover, to prevent litigation concerning intellectual property rights as the Group pursues business development, the Group conducts patent investigations pertaining to intellectual property rights through patent offices, etc., and the Group is not aware of any fact that constitutes an infringement of the intellectual property rights of other companies relating to its technologies. However, it is difficult to completely grasp the intellectual property rights of other companies as pertains to the Group’s business, and we cannot deny the possibility that, without our knowledge, we might infringe upon the intellectual property rights of other companies. In this case, infringement on intellectual property rights could lead to claims for compensation for damages, which may affect the Group’s financial condition and management performance.

(9) System Failure and System Trouble

The Group provides services on the internet using the cloud services of platformers such as Apple Inc., Google LLC, and Microsoft Corporation. Therefore, provision of services by the Group may be hindered in the event of server failure caused by damage to the internet communication network due to natural disasters or accidents, or caused by an unexpected increase in access. In such cases, costs such as compensation for end users may be incurred, and the Group’s financial condition and management performance may be affected.

To address such risks, we are strengthening our system to quickly recover from system trouble, etc., based on distributed backup data.

(10) Internal Controls System and Compliance

The Group appropriately operates an internal controls system in order to ensure the appropriateness of operations and the reliability of financial statements. Moreover, the Group established the Internal Audit Office and has been working to comply with laws and regulations by establishing and enhancing regulations regarding compliance while continuously conducting training and other activities aimed at raising awareness among employees. However, if there is a deliberate or unexpected serious violation of compliance or laws, the Group may lose trust from society, which may affect the Group’s financial condition and management performance.

(11) Status as a Small Organization

The Group is a small organization with 157 employees (as of the end of the fiscal year under review), and our business execution system is designed accordingly. The Group has a policy of training employees, recruiting personnel, and enhancing our business execution system in conjunction with future business expansion. However, if these initiatives do not progress in a timely and appropriate manner, the Group’s financial condition and management performance may be affected. In addition, if, due to an inability to address a surge in the increase in employees or ongoing retirements, business plans fail to progress as expected and, as a result, long-term competitive capability diminishes or loss of opportunities occurs, and the financial condition and management performance of the Group may be affected.

(12) Dependence on a Specific Individual

Since the Group was founded, Tsutomu Sasaki, the Company's founder and President & CEO, has exhibited strong leadership by promoting management policy, planning and executing strategy, and developing systems. The majority of the Group’s intellectual property rights are owned by President Sasaki. Although the Group has delegated authority to the leaders of each department and has built a stable management system, the Group’s financial condition and management performance may be affected if an unforeseen event befalls President Sasaki.

(13) Securing of Human Resources

The Group considers it essential to secure suitable human resources in line with the expansion of its business. In particular, it is necessary to secure human resources who possess high-end technical skills, primarily that of software development, etc.

However, if our securing of human resources does not proceed smoothly, the Group’s financial condition and management performance may be affected.

(14) Diluting Stock Value by Exercising Stock Options

The Company has granted stock options as incentives to officers and employees of the Company. If these stock options are exercised, the Company's stock may be newly issued, resulting in dilution for the value of the stock held by existing shareholders and the voting rights ratio. As of the end of the fiscal year under review, the number of potential shares due to these stock acquisition rights was 93,740 shares, which is equivalent to 1.76% of the total number of issued shares (5,303,750 shares).

(15) Shareholding Ratio of Venture Capital, etc.

As of the end of the fiscal year under review, the ratio of the Group's shares owned by venture capital and investment partnerships composed of venture capital (hereinafter, “Venture Capital, etc.”) is 5.17% of the total number of issued shares of the Company. Due to changes in the Company’s share price, there is the possibility that all or a portion of the shares owned by Venture Capital, etc., may be sold. In such cases, there may be a short-term disruption in the balance of supply and demand for the Company’s stock on the stock market, which may affect the market price of the Company’s stock.

To address such risk, the Company conducts IR activities to soundly shape share prices, such as the holding of results briefings for general shareholders and ongoing meetings with institutional investors, etc., and is taking a medium- to long-term perspective for the cultivation of shareholders.

(16) R&D Expenses

Instead of engaging in contract development, the Group has developed a business model which consists of licensing the technology which we developed in-house. The Group plans to invest heavily in R&D in order to support the foundation of this business model. Based on surveys and reports, the Group decides upon R&D policies by forecasting the needs of users, trends among competitors, etc. However, if actual conditions differ significantly from these forecasts, or if we must change R&D policy, it may not be possible to recover the invested capital and there may be a delay in expansion of business. In such cases, the Group’s financial condition and management performance may be affected.

(17) Investment Business

In order to create new revenue sources, the Group invests in companies whose business is closely related to that of the Group, companies involved in resolving societal issues, and companies who are active in Kyushu, where the headquarters of the Group is located. Depending on the condition of the investee business, the Group may incur losses on the valuation of securities held that affect the development of its business, its operating performance, and its financial position. In addition, there is no guarantee that shares, etc. in which the Group invests will be sold for a higher value than their acquisition cost, which may lead to an inability to achieve expected capital gains, or to recover funds invested.

(18) Overseas subsidiary

The Group has as its overseas subsidiary a software development company located in Vietnam. In addition to engaging in outsourced development locally, some development operations are outsourced to this subsidiary from the parent company. Accordingly, in the event of changes in Vietnam's politics, economy, or legal system, or of social unrest caused by war or terrorism, or of drastic and unforeseeable changes in the labor environment, the Group’s financial condition and management performance may be affected. Although the subsidiary became a consolidated subsidiary in the current fiscal year, only its balance sheet is consolidated in the current fiscal year because the deemed acquisition date is April 1, 2024.

(19) Fluctuations in exchange rates

The Group’s mainstay CLOMO Business provides MDM services to corporations in the form of SaaS, using the cloud, and the cost of sales includes cloud service usage fees. Because these fees are mainly denominated and paid in U.S. dollars, in the event of an increase in the cost of sales caused by a rapid depreciation of the yen, the Group’s financial condition and management performance may be affected.In addition, the Group has an overseas subsidiary based in Vietnam,when translating the financial statements of this subsidiary into yen,and exchange rate fluctuations may affect the Group’s financial condition and management performance.

Disclosure Policy

(1) Information Disclosure Standards

In accordance with laws and regulations such as the Financial Instruments and Exchange Act and the “Timely Disclosure, Etc. of Corporate Information” (hereinafter, “Timely Disclosure Rules”) of the Securities Listing Regulations established by the Tokyo Stock Exchange, the Company promptly discloses information based on the concepts of transparency, impartialness, and continuity. Furthermore, we will proactively and fairly disclose information that we consider important or useful for shareholders and investors to understand the Company, even if such information is not subject to the aforementioned laws, regulations, or Timely Disclosure Rules. The Company will not disclose personal information, customer information, or information that would infringe on the rights of related parties.

(2) Method of Information Disclosure

In regards to information disclosure as defined in the Timely Disclosure Rules, after disclosure via the Timely Disclosure Network (TDnet) provided by the Tokyo Stock Exchange in accordance with said rules, the information will be promptly posted on the Company's website. Even in the case of information that does not fall under the Timely Disclosure Rules, information will be widely disclosed via posting on the Company’s website and the like if said information is deemed to be important or useful.

(3) Prevention of Insider Trading

Regarding the prevention of insider trading, etc., we have established Internal Transaction Management Rules to prevent insider trading. Also, the Company has policies for periodically holding internal training and ensuring a high level of awareness among officers and employees in order to prevent insider trading not only of the Company’s stock, but also of stock of business partners, etc., for which insider information may be known through the course of business.

(4) Handling of Business Forecasts and Future Information

Among the business forecasts, future prospects, strategies, targets, etc., disclosed by the Company, those other than items regarding past or present facts are forward-looking statements. These forward-looking statements are based on plans, expectations, and judgments utilizing certain assumptions which are made using information available to the Company at the current point and which are judged to be reasonable. Actual business results, etc. may differ from the disclosed business forecasts due to various fluctuating factors of uncertain elements such as economic conditions.

(5) Silent Period

In order to prevent leakage of financial information (including quarterly financial information) and other information that affects the stock price, the Company has established a silent period from the day after the closing date of the quarter to the date of announcing financial results for the full period. During the silent period, the Company refrains from making any comments on financial results. This shall not apply if the Company judges that the information in question has or may have a significant impact on the capital market. In regards to business forecasts, revisions to dividend forecasts, and explanations of differences, the Company will engage in timely disclosure in accordance with the Timely Disclosure Rules.